Planning a charter on a luxurious yacht is an exciting endeavor, filled with anticipation and dreams of exploring the open seas. As you embark on this journey, one important question may come to mind: do I need travel insurance for my charter? In this article, we will delve into this topic and provide you with all the information you need to make an informed decision. Whether you’re a seasoned yacht charterer or a first-timer, understanding the importance of travel insurance can help ensure a worry-free and enjoyable experience. So, let’s dive in and explore the world of charter travel insurance together.

Do I need travel insurance for my charter?

When it comes to planning a charter vacation, there are many factors to consider, and one important question that often comes up is whether or not you need travel insurance. While it may seem like an unnecessary expense, especially if you’re already spending a significant amount on your charter, travel insurance can provide peace of mind and protect you from unexpected situations. In this article, we will explore the benefits of travel insurance for your charter and help you decide if it’s the right choice for you.

What is travel insurance?

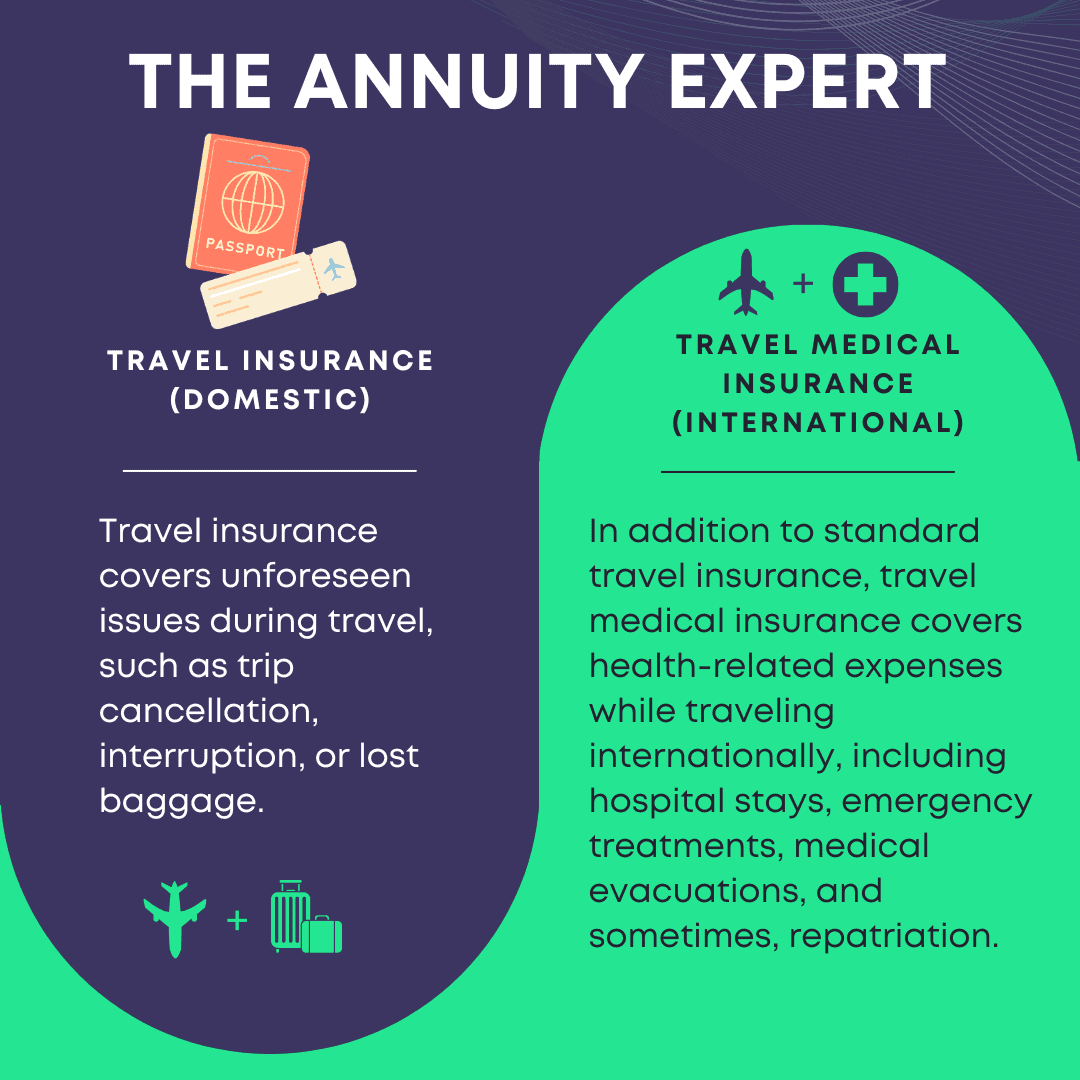

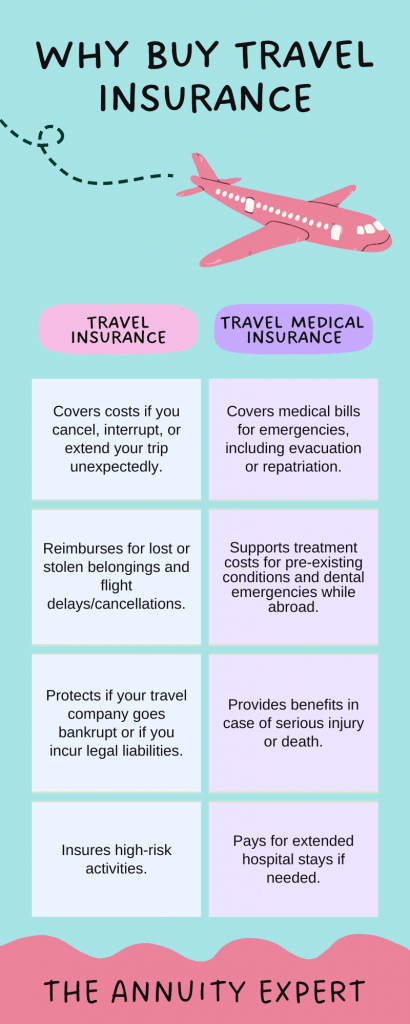

Travel insurance is a type of coverage that protects you financially in the event of unexpected events or emergencies while on your trip. It typically covers expenses such as trip cancellation or interruption, medical emergencies, lost or delayed baggage, and travel delays. The specific coverage and policy details can vary, so it’s important to carefully review the terms and conditions of any travel insurance you’re considering.

This image is property of www.forbes.com.

Why consider travel insurance for your charter?

While you may think that nothing will go wrong during your charter vacation, it’s always better to be prepared for the unexpected. Here are a few reasons why travel insurance may be worth considering for your charter:

Trip cancellation or interruption

Life is unpredictable, and sometimes circumstances arise that may require you to cancel or cut short your charter. Travel insurance can help protect your investment by reimbursing you for non-refundable expenses, such as the cost of the charter itself or any pre-booked accommodations or activities.

Medical emergencies

Accidents and illnesses can happen anywhere, even on vacation. If you or a member of your travel party were to experience a medical emergency while on your charter, travel insurance with medical coverage can help cover the costs of medical treatment, hospitalization, and emergency medical evacuation if necessary.

Lost or delayed baggage

Imagine arriving at your charter destination only to find that your luggage has been lost or delayed. Travel insurance can provide coverage for the cost of replacing essential items or compensating for the inconvenience caused by the loss or delay of your baggage.

Travel delays

Whether it’s due to weather conditions, mechanical issues, or other unforeseen circumstances, travel delays can disrupt your charter plans. With travel insurance, you can receive compensation for additional expenses incurred due to travel delays, such as hotel accommodations, meals, and transportation.

This image is property of www.annuityexpertadvice.com.

What to consider when choosing travel insurance

If you’ve decided that travel insurance is the right choice for your charter, there are a few factors to consider when choosing the right policy:

Coverage limits

Review the coverage limits of the travel insurance policy to ensure they align with your needs. Make sure the policy covers the full value of your charter and any other relevant expenses.

Exclusions

Pay close attention to the exclusions listed in the policy. Some common exclusions may include pre-existing medical conditions, high-risk activities, or certain destinations. Ensure that the policy covers any specific needs or circumstances that are important to you.

Deductibles and co-pays

Take note of any deductibles or co-pays associated with the policy. These are the amounts you would be responsible for paying out of pocket before the insurance coverage kicks in. Consider these costs when evaluating the overall value of the insurance plan.

Assistance services

In addition to coverage for unexpected events, many travel insurance policies offer assistance services such as 24/7 emergency assistance, concierge services, and access to travel resources. These services can be valuable additions to your charter experience, so consider what level of assistance you may need.

This image is property of www.annuityexpertadvice.com.

Final thoughts

While travel insurance may seem like an additional expense, it can provide valuable protection and peace of mind during your charter vacation. Whether it’s for trip cancellation, medical emergencies, lost baggage, or travel delays, having the right coverage can save you from potential financial burdens and help ensure a worry-free charter experience. Take the time to research different travel insurance options, compare policies, and choose the one that best fits your needs. With travel insurance in place, you can embark on your charter adventure with confidence, knowing that you’re prepared for whatever may come your way.